Chiratae Ventures announces key elevations in its growth journey of three Managing Directors and AVP

Bengaluru, 20 th December 2021: Chiratae Ventures announces key elevations in its growth journey of three Managing Directors and AVP

Chiratae Ventures, formerly known as IDG Ventures, has announced the promotion of four key members. Karthik Prabhakar, Ranjith Menon, and Venkatesh Peddi have been elevated to Managing Directors, and Gayatri Menon has been elevated to Associate Vice President – Legal.

Karthik Prabhakar, Ranjith Menon and Venkatesh Peddi have spent over a decade at Chiratae and have worked as a close-knit team. Karthik leads fundraising at Chiratae Ventures and has led investments in EarlySalary, NestAway, PlaySimple and PlayShifu, amongst others. Ranjith, leads Health tech sector and has led investments in GoMechanic, Bizongo, Zumutor, Redcliffe and Uniphore amongst others. Venkatesh, leads the SaasS sector and has led investments in Deepfence, Healthplix, Hevo, Pyxis, among others.

Chiratae Ventures is a leading homegrown early-stage tech VC backing stellar ventrepreneurs disrupting or creating new ecosystems. The Bengaluru based VC fund was co-founded by Sudhir Sethi, Founder and Chairman and TCM Sundaram, Founder and Vice Chairman in 2006.

Speaking about the team and its culture, Sudhir Sethi, the Founder and Chairman of Chiratae Ventures shares: “At the outset my congratulations to Ranjith, Venkatesh, Karthik and Gayatri on their elevation. Their contribution in staging Chiratae Ventures to a leadership position has been outstanding. In pursuing our goal of growing 3x Chiratae leaders are poised to raise multiple funds, invest faster and deliver 3x more exits year by year.”

Sudhir Sethi, Founder and Chairman, with TCM Sundaram, Founder and Vice Chairman, Chiratae Ventures

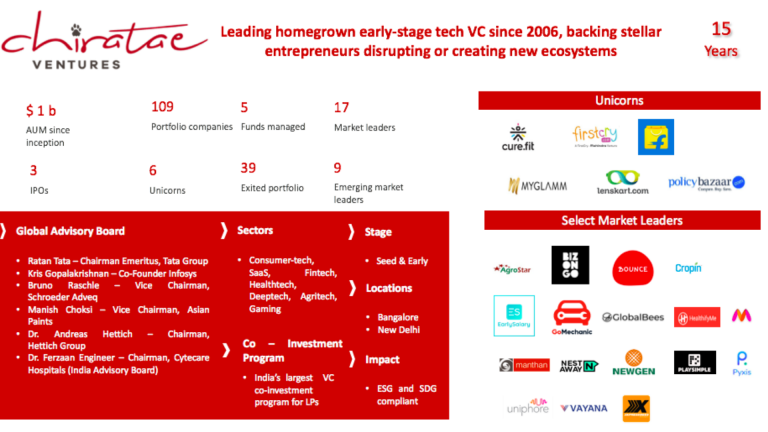

This year also marks a milestone for Chiratae Ventures. It completed its 15 years in the Indian Startup Ecosystem and announced its final close of the fourth fund oversubscribed at $337 million in August. Through the years, the team has delivered value for its investors with over 39 exits and driven portfolio growth as demonstrated by $1 billion AUM since its inception, 3 IPOs and 6 Unicorns, with more round the corner.

Chiratae has been an early backer of AgroStar, Bizongo, Bounce, Cropin, Curefit, EarlySalary, Emotix, Firstcry, GlobalBees, Go Mechanic, HealthifyMe, Lenskart, Myntra, NestAway, Pyxis, Vayana, Uniphore, amongst others.

Matching its scale and growth aspirations, the fund has been beefing up its leadership. The recent promotions are aligned to an overall strategy to provide an accelerated growth path for its team that is expected to grow by 60 percent in the coming months with the addition of another 15 professionals.

The elevations come on the back of seven recent appointments made by Chiratae in its Investment and Marketing teams and align with their growth vision.

TCM Sundaram, Founder and Vice Chairman, shared, “Over the past decade Karthik, Ranjith and Venkatesh have been at the forefront of investing in very successful companies as well as leading sectors for Chiratae Ventures and been role models for our new and younger team members. Gayatri, as legal counsel, has contributed significantly to Chiratae’s investments, divestments and fundraising over the past four years and has become an integral part of the Chiratae Team. I wish the team long and successful innings at Chiratae in creating unicorns and IPO candidates in years to come.”

SaaS and software:

7. Clientell

● Clientell is a no-code decision landscape, empowering business leaders to take data backed decisions and streamline business strategies by leveraging self- evolving AI. Founded by Saahil Dhaka and Neil Sarkar batchmates from BITS Pilani, Chiratae Ventures led the investment as the sole investor.

8. Goodmeetings

● Goodmeetings is an online video and AI-enabled platform that helps sales teams sell 10X better over video calls. They do this by providing AI powered dynamic nudges, checklists, help on the fly, workflow automation and useful insights to improve sales productivity, efficacy and decision making. Founding team comprises of serial entrepreneurs Srinivasan Narayan, Soumya Mohapatra, Abhijeet Sahoo, Alok Mishra and Ajay Srinath. Chiratae led the investment round with participation from FortyTwo.VC, Adept Ventures, 100X.VC, Atrium Angels and marquee angels.

9. HUVIAiR

● HUVIAiR is a construction technology company that helps businesses through its visual intelligence technology platform to enhance on-site productivity and reduce progress monitoring time while cutting down on overall project costs. HUVIAiR was founded by Vikshut Mundkur and Arjun Janananda. Chiratae Ventures led the investment with participation from SOSV, Artesian Venture Partners and RMZ Management LLP.

10. Locale

• Locale is a control tower for central oversight and localised decisions for real-world operations. It optimizes your operations with powerful map-based analytics, hyperlocal insights and granular decisions. Locale currently works with some of the world’s largest companies, including those in Europe, Latin America, the Middle East, India, and Singapore, to name a few. Locale was founded in 2019 by Aditi Sinha, a BITS Pilani graduate, and Rishabh Jain, who worked extensively on geographic information systems at Social Cops. Chiratae led the company’s seed round in August 2021.

11. NetBookAI

● NetBook is a platform to abstract out the entire compute infrastructure layer from Machine Learning workflows, thus enabling Machine Learning developers to save 90% of their time that is lost due to compute bottlenecks. NetBook enables teams to connect all their private and cloud servers to manage workloads across their entire infrastructure seamlessly from a single dashboard. NetBook was founded by Sachin Chandra Bonagiri and Siddhardha Sukka who possess a broad experience in developing ML solutions and products after graduating from IIT Bombay as batchmates earlier. Chiratae Ventures led the investment as the sole investor with participation from marquee angels.

DeepTech:

12. DreamVu

● DreamVu is a pioneer and the leader in omnidirectional 3D vision systems. It leverages patented optics with visual imaging software to create affordable omnidirectional 3D vision systems to solve some of the most challenging problems in vision globally with large scale use cases in the industrial automation space. DreamVu was founded in 2017 by IIIT Hyderabad alumni Rajat Aggarwal, Rohan Bhatial and Professor Anoop Namboodiri. Chiratae led the investment round with participation from existing investors SRI Capital and Philadelphia Angels.

13. Expertia AI

● Expertia AI is a deeptech SaaS platform with a virtual recruiter for businesses to identify top talents instantly. The company is on a mission to eliminate search, bias, error and delays from skill discovery, development and deployment. It was founded by Akshay Gugnani a Computer Science alumni of MIT and serial entrepreneur Kanishk Shukla. Chiratae Ventures and Endiya Partners led the investment round with participation from Entrepreneur First.

14. Metadome.ai

● Metadome (formerly Adloid), is a Metaverse that provides no-code infrastructure to millions of creators and leading brands to build immersive experiences in the virtual world. Metadome is empowering leading brands with AR deployments across automobile, home decor, beauty and accessories, and consumer electronics. The founding team comprises serial entrepreneurs Kanav Singla, Prashant Sinha and Shorya Mahajan. Chiratae co-led its investment with Lenskart Vision Fund.

HealthTech:

15. AroLeap

● AroLeap is an intelligent strength training device designed to deliver data-driven personal training in the most convenient and engaging manner. With a requirement of just a 5ft x 2ft wall space for the device, AroLeap plans to revolutionise personal fitness training across India. The founding team comprises four batchmates from IIT Delhi Aman Rai, Anurag Dani, Rohit Patel and Amal Mechirackal. Chiratae Ventures co-led this investment with Sauce.vc and Whiteboard Capital

16. ClaimBuddy

• ClaimBuddy is a MediClaim support company that acts as one-stop solutions for claim assistance for patients & hospitals. They are disrupting this highly broken market by leveraging technology and efficient processes and operations. Claimbuddy is founded by Khet Singh and Ajit Patel who bring prior rich experience from the insurance space and high growth stage startups. Chiratae Ventures co-led the investment round with Rebright Partners with participation from existing investor Titan Capital.

17. Hexa Health

● Hexa Health aims to be a one stop platform for a patient’s hospitalization needs. By facilitating patients discover the right doctor at the best price for their IPD requirements and assisting them for a hassle-free hospitalization experience, Hexa Health is addressing the huge gap in quality, seamless and trustworthy medical care in India. Hexa Health was founded in 2021 by Ankur Gigras, Vikas Chauhan and Aman Khanna, with the team having years of experience in the healthcare domain across leading startups, marquee consulting firms and industry giants. Chiratae Ventures co-led its investment with Omidyar Network with participation from marquee angels from the healthcare industry.

Others:

18. Stealth Company

● Chiratae Ventures also invested in a company in stealth mode in the space of B2B services

19. Deeptech Company

● Chiratae Ventures is also in the process of closure of seed investment in a Mobility deeptech company.

About Chiratae Ventures:

Launched in 2006, Chiratae Ventures India Advisors a home grown early-stage tech Venture Capital Fund backing stellar entrepreneurs disrupting or creating new ecosystems, the fund has been an early backer of Curefit, Firstcry, GlobalBees, Lenskart, and Myntra, and has invested in leaders like AgroStar, Bizongo, Bounce, Cropin, EarlySalary, GoMechanic, HealthifyMe, NestAway, Pyxis, Uniphore, Vayana, amongst others. In its 16th year of existence, Chiratae closed its fourth fund oversubscribed at $337 Million in 2021. Through the years, the team has delivered value for its investors with 40 exits and driven portfolio growth as demonstrated by $1 Billion AUM since its inception, 3 IPOs and 8 Unicorns, with more round the corner.