Teladoc + Livongo : Building towards the future of healthcare

Aug 12, 2020

‘Mega M&A’ has been a big chatter topic for the past few weeks in the technology world. While in the US, everyone has been discussing if the next home for their favourite Tiktok videos would be Microsoft or Twitter; back home in India, the ecosystem witnessed the acquisition of WhiteHat.Jr by Byju’s in what has been a defining year for ed-tech.

Another sector for which Covid-19 has been a foot on the acceleration pedal is digital health, which saw its largest global deal announced last week. Teladoc Health ($TDOC) a provider of virtual care services announced its acquisition of Livongo ($LVGO), a provider of chronic disease management and remote patient monitoring services at a purchase price of $18.5Bn to create a combined public-listed entity worth $38Bn. This deal eclipses earlier transactions including the $5.7Bn acquisition of Athenahealth, Google’s $2.1Bn bid for Fitbit, and Amazon’s $750Mn bid for PillPack among others.

What makes the deal unique is the fact that both parties are publicly listed digital-health companies that have been market leaders in their own niche. It is not a distress deal or a deal to ensure survival or kill competition but is a deal that explores strong synergies to create a giant in the emerging field of consumer-centered virtual care and shake up the existing providers in the healthcare ecosystem.

How big is this mega-deal?

The combined entity of Teladoc = 58% of Teladoc shareholders + 42% of Livongo shareholders, with $LYGO shareholders receiving 0.592 shares of Teladoc plus $11.33 in cash per Livongo share.

Putting the $18.5 billion purchase price in the context of Livongo’s share price and financial performance

- 10% premium to $LVGO share price a day before

- 50% premium to $LVGO share price a week before

- 6x premium to $LVGO share price at the start of the year

- 30x on the company’s projected revenues for FY2021

While these appear like lofty numbers, it looks to be a well-deserved price for a company that IPOed a year back at a $2.5Bn valuation and became a less-popular darling (unlike Zoom) of the wall street with a 250% stock jump amidst a stellar 128% YoY growth and hefty 75%+ gross margin.

Teladoc, for which inorganic growth isn’t a new thing, wouldn’t have minded the premium as well as its own stock has grown at a 50% CAGR since an IPO, 5 years ago, with another 200% stock jump in this year alone.

The combined company with a total worth of $38Bn is expected to do revenue of $1.3 billion in 2020 with 85% growth compared to last year.

Teladoc — Business Model, Changes post Covid-19 & Why this deal?

Business Model

One of the earliest players to place its bets on virtual care, the company adopted a strategy of going B2B2C with 75% of its revenue coming from subscription fees paid for by employers and insurers, for provision of a range of virtual care services, including specialty and mental health needs through a physician network of 55k+ independent contractors. It scaled to 70Mn users in the US alone, with services scaling to 175 countries over their 18 years of operations.

What changed post Covid-19?

Telemedicine became hot due to Covid-19, leading to 85% YoY growth in revenues and 200% growth in visits. However, telemedicine also turned from being a moat to a commodity.

Why this deal?

It helps build a more comprehensive solution by integrating a data-driven health management system on top of their one-one virtual care platform to drive LTV numbers and product utilization rates that keeps competition at bay.

Livongo — Business Model, Changes post-Covid-19 & Why this deal?

Business Model

A technology platform combining smart, cloud-connected devices and testing strips, data science, and personal coaches to deliver meaningful health insights and behavior change to manage the chronic conditions including diabetes, hypertension, weight management, and mental health for a TAM of 133Mn+ US adults. Adopted a B2B2C strategy of monetization through employers and insurers allowing it to scale to more than 340K+ members.

What changed post Covid-19?

Demand soared (120% YOY growth in revenues and members) as focus on employee well-being and self-monitoring of chronic patients grew.

Why this deal?

It’s a great price! Also, the company probably saw the Microsoft Teams vs Slack adoption chart to realize that their B2B model would scale and distribute faster with Teladoc’s global reach, Fortune 500 intros (P.S 40% of Fortune 500 companies are Teladoc clients) and a horizontally integrated care bundle; before competition caught on amidst heavy demand.

Potful of Synergies

The deal combines two highly complementary pioneers to deliver a proactive engagement model for patients which Teladoc has defined as ‘whole person care’. The merger accelerates Teladoc’s vision of creating a seamless continuum of personalized, tech-driven longitudinal virtual care that improves health outcomes, cost of care, and member convenience, thereby boosting its subscription economics.

“By combining Teladoc’s telehealth capabilities with Livongo’s chronic disease management and remote patient monitoring services, Teladoc will now have a “depth and breadth of services that is unmatched by any other company in the digital health space” — Jason Gorevic (CEO, Teladoc)

The deal also creates a leading player in the mental health space (which has seen increased interest over the past few quarters) as Teladoc’s virtual mental health offerings get combined with Livongo’s behaviour health business called MyStrength.

What’s interesting beyond the strategic synergies is the already identified revenue synergies of~$100Mn in 2 years, ~$500Mn in the next 5 years as well as a 30–40% CAGR projection for overall revenue and 200–300 bps of positive adjustment in EBITDA. The synergies are driven by the huge cross-sell potential which gets unlocked due to a limited overlap of <25% in the existing client bases.

Vote of Confidence in Digital Health

The Teladoc-Livongo deal is a big signal of what the future of digital health could look like- a technology-first patient-centric full-stack (3 important phrases in there!) care delivery; and opens up the door for more M&As and IPOs for digital healthcare startups building towards this future.

This is evident from the post-announcement stock price gains of some of Teladoc & Livongo’s competitors including Dariohealth (which was up by 30%!) as the public market doubled down on its trust in the potential of the various digital health solutions out in the market to not just augment but also take on the existing providers and disrupt healthcare.

While the shares of these two parties fell after the deal, it was more of a change of guards as the traders who had enjoyed the rally of the digital health market leaders cashed out, while a few others weren’t able to benchmark the valuation premiums and future growth rates as both market-leading growth stocks merged. Healthcare analysts and long-term investors have however continued to be long on the combined Teladoc entity and other digital healthcare companies as they move from the fringes to the core of the care delivery ecosystem.

What makes digital health click?

The big shift in the form of digital healthcare has been in the reckoning for a while. The COVID-19 pandemic has accelerated it. As existing health providers are bolting virtual care onto their physical world practice, they now are pitted against the digital-first service providers.

While going virtual is the first step in digital health as it solves for convenience and accessibility, its real value creation lies in its tech-first, patient-centric model that maximizes for health outcomes instead of volumes.

1) Enabling digital co-ordination of care delivery allows for more flexibility and choice in the hands of the patients as compared to the non-assistive and locked ecosystems of traditional care providers. Digital care does not rob off the mandated offline interactions in healthcare but instead endeavours to maximize the outcome of such interactions while solving for the demand-supply gap realities.

2) Adopting a full-stack play enables building a patient’s longitudinal view through integration of medical records and lifestyle data, that allows for the AI to be applied for personalized diagnosis, safer care delivery as well as easier, faster clinical trials. With building trust with consumers being extremely critical, more so in the healthcare domain, developing vertical full-stack platforms around disease conditions, in many cases, help create better depth of understanding of a disease thereby leading to more accurate solutions for consumers.

3) Proactive and sustained patient engagement as compared to the traditional point of time reactive approach to care delivery that waits for symptoms, leads to a lesser burden on the health infrastructure as well as on the medical spends of patients.

Stronger case in the India context

What makes the case for digital health stronger in India is a multitude of unique insights and data points emerging from the existing healthcare landscape here.

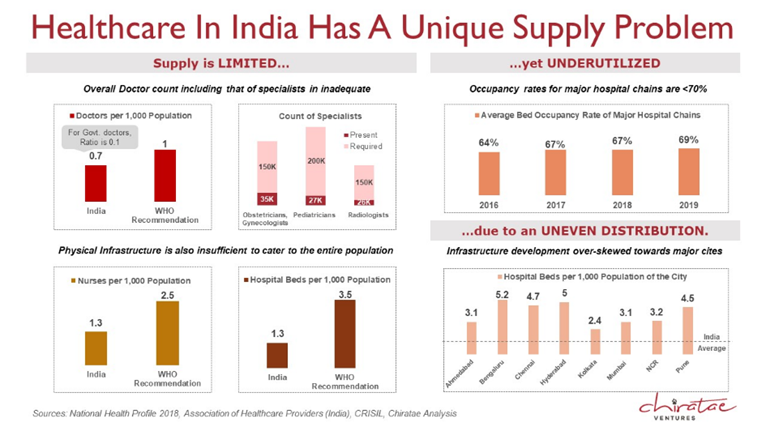

1) Infrastructure and care provider supply is limited with an unequal distribution skewed towards the metros — While smartphone penetration has grown within Bharat, healthcare infrastructure hasn’t seen a similar journey, thereby leaving the opportunity to tackle the age-old challenges of awareness, affordability, and accessibility in the hands of the emerging digital-health players.

2) Limited penetration of insurance: With out of -pocket expenditure accounting for 70% of the wallet spends on healthcare, the payor-provider nexus, where the patient is locked in with a limited list of providers is not a defining constraint in India compared to the US. This, along with the proximity constraint to care delivery going down, allows patients to choose from a wider pool of provider options, thereby bringing patient-centricity to the core of care delivery.

Digital health enables a global-maxima for health outcomes compared to the earlier possible local maxima constrained by location and lack of choice.

3) Land of chronic patients & change behavior towards B2C diagnostics: 20% of the Indian population suffers from at least one chronic disease which is responsible for 60% of total deaths, yet the % penetration of blood pressure monitors and glucometers has remained at low double digits. (One in 10 in case of glucometers among 70Mn odd diagnosed diabetes patients)

The spread of Covid-19 however, has caused the seepage of the habit of self-monitoring and self-reporting into the routine of the general populace. (Case in point — 150Mn+ downloads of the Aaarogya Setu app and shortages of oximeters across the country as sales hit the roofs). This behavioural change could usher in a new phase in the growth of longitudinal health data of patients which is a key armour for digital health in its battle to drive improved health outcomes.

Hunt for India’s healthcare large-cap

There are hardly 5–6 players with a valuation >$100Mn in India’s $250Bn macro healthcare market, with the largest company (Apollo Hospitals) amounting to ~1% of the total market size, a % that is comparatively low compared to most other sectors in the public market.

While it is early days for digital healthcare, we are hopeful that a patient-centric digital play that enjoys a high NPS from patients (through value-based care and improved health outcomes) and leverages the regulatory tailwinds of soon to be announced National Digital Health Mission and Bharat Health Stack initiatives (more on this later!) could become the first much-awaited mega-company in the healthcare space. 🚀🤞

Disclaimer: Views and opinions expressed are the author’s own and do not necessarily reflect the views and opinions of Chiratae or its employees.